REVIEW: NAIS Scheme Transforms Eastern Province Farming, Offers Financial Lifeline Against Climate Shocks

The National Agriculture Insurance Scheme (NAIS), locally known as “Tekana Urishingiwe Muhinzi-Mworozi” (“Smallholder farmer, feel safe, you are insured”), is being widely hailed across Rwanda’s Eastern Province for shielding farmers and livestock keepers from catastrophic financial losses. Following a recent mobilization and assessment tour across four key districts—Bugesera, Kayonza, Ngoma, and Nyagatare—reports confirm that the government-backed insurance program is delivering rapid compensation and restoring confidence in agriculture amidst escalating climate change impacts.

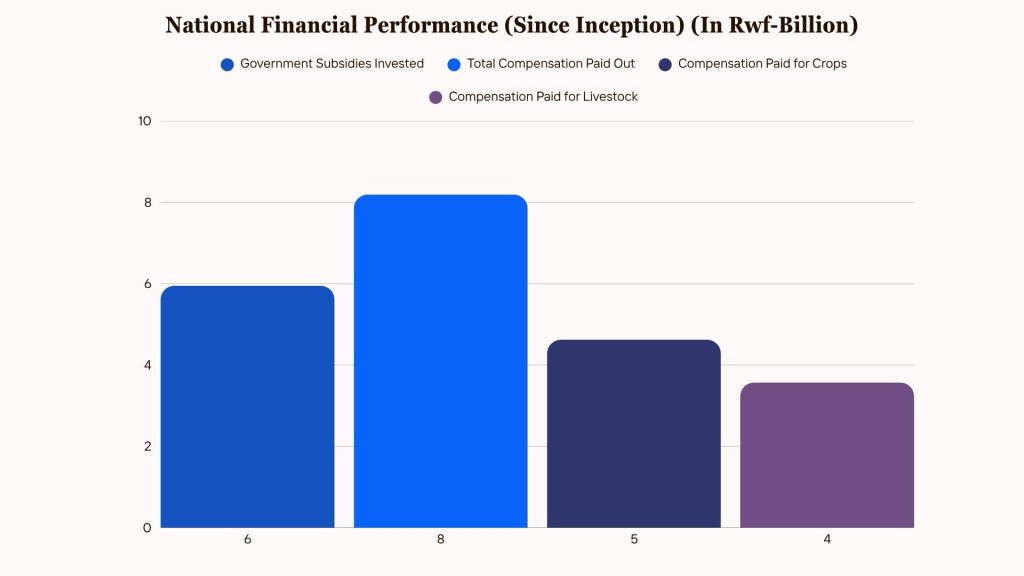

The scheme, launched in 2019 by the Ministry of Agriculture and Animal Resources (MINAGRI), is implemented by the Rwanda Agriculture and Animal Resources Development Board (RAB) through its Single Project Implementation Unit (SPIU). To ensure affordability for smallholder producers, the government provides a substantial 40% subsidy on insurance premiums.

Bugesera: Turning Devastation into Recovery

In Bugesera, an area frequently battered by both drought and floods, farmers attest that the insurance has restored their ability to invest confidently.

- Financial Lifelines: Edouard Bamporiki, a farmer who insures his maize, chili, beans, cows, pigs, and chickens, said that insurance gives farmers hope for recovery when weather changes or diseases strike. He was compensated after a recent chili harvest loss, where he yielded only five tonnes instead of the expected 14 tonnes.

- Cooperative Success: The Ize-Mugema Cooperative, which grows maize, rice, and other crops, received RWF 3 million in compensation in Season B of 2024 following a severe drought. Cooperative president Beatha Ntabanganyimana affirmed that the program truly helps farmers recover and encourages them to expand production.

- Livestock Security: Livestock farmer Isaac Mahoro was reimbursed RWF 15 million after losing more than ten cows to disease since 2019, stating that before the program, he considered quitting farming entirely.

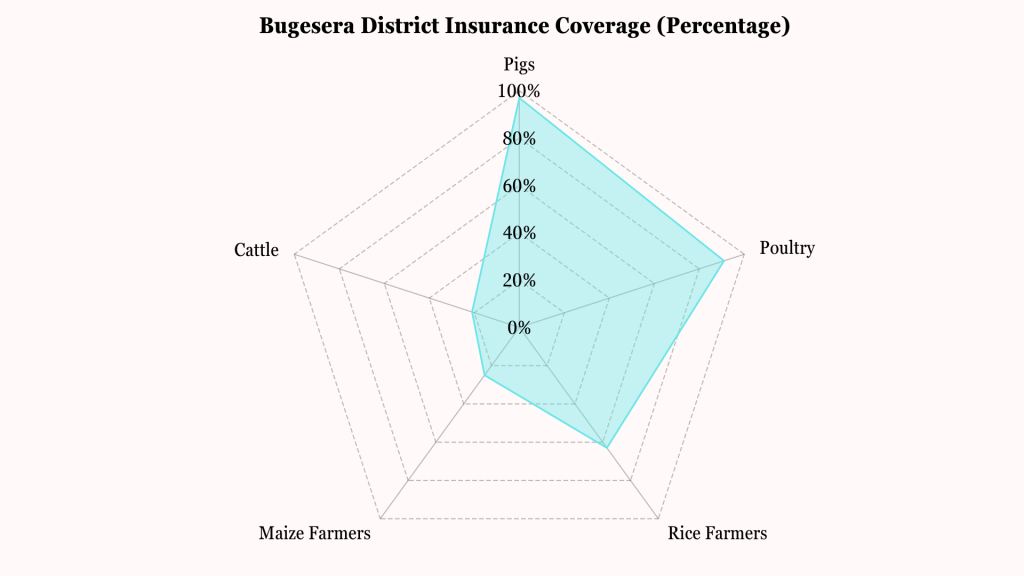

- Challenges: Despite these successes, Bugesera District Mayor Richard Mutabazi noted that the number of insured farmers is still low, though coverage is high in certain segments (97% for pigs and 91% for poultry).

Kayonza: Overcoming Skepticism

Kayonza District faces persistent challenges from droughts, floods, and diseases like Foot and Mouth Disease in cattle and Newcastle Disease in poultry. Mayor John Bosco Nyemazi highlighted that agricultural and livestock losses have “significantly decreased” since the program’s introduction.

- Mindset Change: The KOAISORWA Cooperative initially viewed the scheme skeptically. This changed dramatically after strong winds damaged their maize crop, resulting in a compensation payout of Rwf 740,000. The compensation allowed them to replant without incurring debt.

- High-Value Compensation: Retired Colonel Evariste Rugangazi, a dairy farmer, was compensated over Rwf 17 million after losing 11 cows to disease, demonstrating the “real value of insurance”.

- Progress: Kayonza is actively campaigning for increased enrollment, aiming for full coverage of maize (400 hectares) and rice (2,000 hectares) by 2025.

Ngoma: The Value of Protection

In Ngoma District, farmer enthusiasm is on the rise, signaling a change in mindset where insurance is viewed as a “safeguard for livelihoods”.

- A Costly Lesson: Professional dairy farmer Alex Nzeyimana was heartbroken and suffered huge losses when his best cow, which produced 28 liters of milk per day, died uninsured in 2020. Since joining, he has received compensation for three cows, including one worth Rwf 1.3 million, bringing him stability and peace of mind.

- Affordability Factor: Nzeyimana stressed that the insurance is not expensive, noting that the premium for a milking cow can be covered by the sales from approximately six days of milk production.

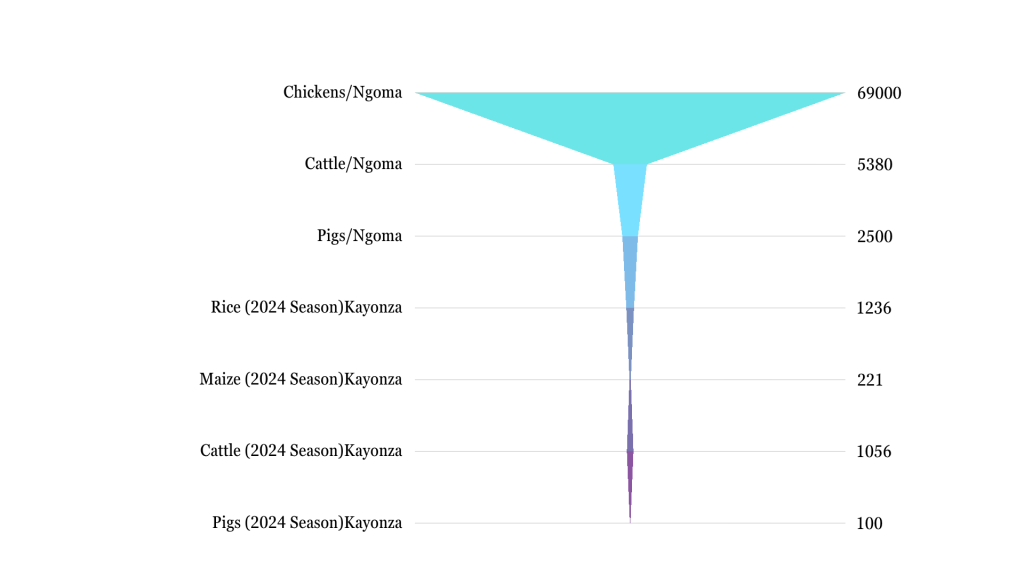

- Current Coverage: Vice Mayor Cyriaque Mapambano Nyiridandi reported that the district currently has 69,000 chickens, 5,380 cattle, and 2,500 pigs insured under the scheme.

Nyagatare: Determined to Meet Targets

Following recent awareness campaigns, farmers in Nyagatare District have pledged to join Tekana to protect themselves from losses caused by natural disasters.

- Rapid Response: The COPEDECOM Cooperative confirmed that they now receive compensation rapidly after incidents like flooding caused by heavy rains.

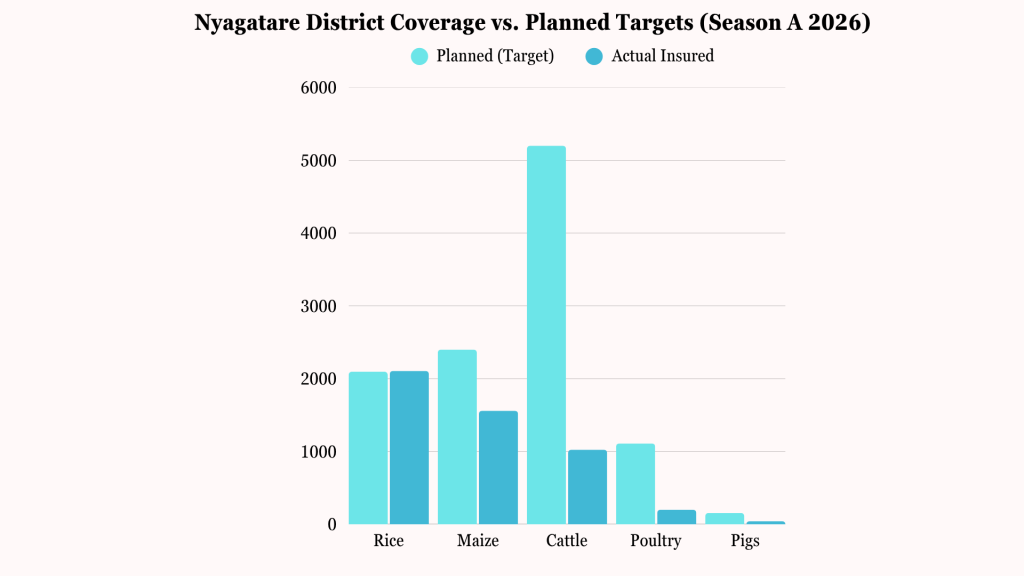

- Performance Metrics (Season A 2026): Nyagatare has made notable progress, particularly in crops. They insured 1,560 hectares of maize (out of 2,400 ha) and successfully exceeded their plan for rice coverage, insuring 2,106.5 hectares. In livestock, 1,025 cattle, 200 poultry, and 42 pigs were insured.

- Lingering Challenge: Vice Mayor Gonzague Matsiko acknowledged that while the district is determined to meet performance targets, some farmers still rely on traditional methods and remain reluctant to join the scheme.

Transforming Agriculture

Dr. Solange Uwituze, Acting Director General of RAB, emphasized that NAIS is crucial for transforming agriculture into a more secure and bankable sector. The scheme allows farmers to access credit more easily because their assets are covered. This aligns directly with Rwanda’s National Strategy for Transformation (NST2), which aims to increase agricultural lending from six to ten percent by 2029.

While the successes and testimonies are strong, officials continue to push for greater adoption. Nationally, the scheme has insured approximately 189,734 farmers and livestock keepers since its launch, representing about six percent of all farmers in Rwanda. RAB officials are intensifying mobilization efforts, using the powerful testimonies of beneficiaries like Bamporiki, Mahoro, and Nzeyimana to inspire others and ensure that farmers can continue producing and investing confidently.

By TOP AFRICA NEWS Review Team

SUBSCRIBE TO OUR NEWSLETTER